By George P. Brockway, originally published May 9, 1994

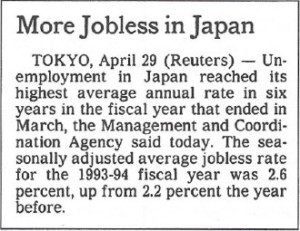

I REPRODUCE above in its entirety a news article that appeared on page D4 of the Business Day section of the New York Times for Friday, April 29, 1994. Don’t feel badly if you can’t recall seeing the story in tile paper. It was easy to miss. It ran in the gutter at the very foot of the page and was surrounded at its top and left by an article from a stringer headlined “Denver Airport Date Firm” (on Sunday the date turned out for the nth time not to be firm). If you were the editor of what you proudly and properly referred to as a newspaper of record, and you had a story you wanted to kill yet had to print in order to complete the record, you would handle it in just this way.

I leave to others the task of speculating why the Japanese unemployment story was in fact buried; why, given its explosively dramatic contrast with American and European unemployment records, it was not run as the lead on the first page of the Business Day section, if not on the front page of the entire paper; why the bare numbers were not accompanied by a backgrounder explaining how the Japanese manage such a low unemployment rate even in the midst of a recession; why nothing about the story has appeared among the concerns of the editorial page or the Op- Ed page; why the Times economics columnists have found nothing to remark on in a report that renders suspect the barbaric but fashionable theory of a natural rate of unemployment, a smattering of whose arcane details they dazzle us with now and then.

Although I will not speculate, I am interested in that last point. For as I have said often enough, I follow Keynes (and indeed everyone at all capable of empathy with a fellow human being) in holding that an outstanding fault of the economic society in which we live is its failure to provide full employment. The theory of a natural rate of unemployment, subscribed to by almost every conventional economist in the United States, argues that this outstanding fault cannot be corrected without igniting an inflation that would destroy the economy.

The news from Tokyo tells us that the current unemployment rate in Japan, while the highest in six years, is nevertheless lower than the lowest unemployment rate the United States has posted since World War II. I do not have at hand Japanese figures earlier than 1967, but after that date Japan’s unemployment has never been higher than 2.9 per cent and U.S. unemployment has never been lower than 3.4 per cent. The American low was registered during the Vietnam War. Our present rate (achieved during a sluggish peacetime recovery that has scared the Federal Reserve Board silly with nightmares of future inflation) is almost three times the present Japanese rate (achieved during a persistent recession).

These facts strongly suggest that the so-called natural rate need not be accepted as immutable. What the Japanese have done is surely within our capabilities; and given the freedom, not to say volatility, of American life, a 2.6 percent rate would be as near full employment as never was.

The natural rate theory has from the beginning allowed that the rate is not really natural but depends on “market characteristics” that are, as Milton Friedman has said, “man-made and policy-made.” What man and policy make they presumably can unmake. The chief market characteristic complained of by natural rate theorists is a minimum wage law. Emboldened by my recent adventure in investigative reporting (see “Ending Welfare As We Know It,” NL, March 14-28), I phoned six Japanese agencies (four of them official) and one American labor union to find out whether Japan has a minimum wage law. No one knew offhand, but the consulate called me back a couple of hours later to report that indeed Japan has such a law. It is a national law, and it specifies minimum wages for different trades and different localities. I doubt that natural rate theorists, who are firm believers in market discipline, would think it an improvement on the American law.

Let us therefore consider the reaction of conventional theory to a 2.6 per cent unemployment rate. Without doubt the prescription would be for a high-very high-interest rate to contain inflation. Has that been prescribed in Japan? Indeed it has not, nor has such a regimen been followed. Rather the contrary, the interest earned by a 1O-year government bond in Japan is now 4 per cent; with us, the corresponding rate is, as I write, 7.10 per cent and will go higher before you read this, if the present majority of the Federal Reserve’s Open Market Committee has its way.

Well, then, since Japan has comparatively low unemployment and comparatively low interest, it must, according to conventional theory, have comparatively high inflation. But Japan’s price index changed 0.0 per cent in April and, at least from 1967, has never climbed as fast as ours.

IT IS OF COURSE possible that other elements contribute to the differences between Japan and the United States. I can name three that may: import policy, productivity and saving.

We all know about Japanese import policy. It is difficult, devious, protectionist, and successful. Twelve years ago I wrote the first of several columns arguing for a protectionist policy for the United States (“America’s Setting Sun,” NL, June 14, 1982). I don’t propose to repeat myself now, except to remark that Japanese protectionism has obviously not prevented the success of Japanese policies directed toward low unemployment, and may well have been a factor in their success.

Productivity is another question I have addressed several times (first in “Productivity: The New Shell Game,” NL, February 8, 1982). In the present context all that need be said is that American productivity is now, and as far as I have been able to discover has always been, greater than Japanese. In fact, among the leading industrial nations, only British productivity has generally been outranked by the Japanese.

On the other hand, Japan’s GNP has, until the last couple of years, grown faster than ours. Conventional economic theory, though, is possessed of the altogether unintelligible notion that productivity is more desirable than production. It may work out that way in a mathematical model, but it certainly doesn’t on the dinner table[1].

I have also written about saving and shall do so again, but the problem with respect to Japan is special. In the first place, a 1990 study by Fred Block in the Journal of Post Keynesian Economics demonstrated that the figures usually published overstate Japanese saving and understate American. In the second place, as Block showed, an extraordinary amount of Japanese saving, however defined, goes into speculation rather than production. The real estate (land and improvements) of Japan, a nation whose area is no greater than that of Montana, is, at today’s prices, more valuable than the real estate of our 48 contiguous states (a not inconsiderable amount of which is owned by Japanese). The Japanese stock exchange is notoriously volatile, with daily spikes (or spike holes) of 5 per cent or more not uncommon. Keynes thought Americans were addicted to gambling, but the Japanese seem to have it worse.

All of their speculation absorbs enormous amounts of money, but it does nothing for the economy. The money is saved in the sense that although it was earned in the producing economy, it is withheld from use in the producing economy. The withholding is achieved by underpaying large classes of workers, especially women, and by underfunding social services. Because of its hierarchical distribution of wealth and its systematic maldistribution of income, Japan cannot consume all it produces and must sell overseas; thus when foreign markets falter, Japan suffers recession.

In short, neither Japanese import policy, nor Japanese productivity, nor Japanese saving can account for Japan’s low unemployment coupled with low inflation. So is there nothing we can learn from the Japanese record? There are, I think, a couple of things. In the circumstances, the actual virtues (as opposed to the theoretical vices) of some sort of protectionism are very hard to deny, as are the virtues of a steadily low interest rate.

Regarding the latter point, we are told that we cannot afford a low rate because it would stimulate a flight of capital to the Bahamas or the Caymans or perhaps some more exotic land farther overseas. I don’t know about that. Even in the early ’80s, when the prime rate here hit 21.5 per cent, and the Japanese rate was as low as it is now, only a small proportion of the yen flew here. Why did most of it stay home? For the good and simple reason (as Tom Swift used to say) that with a low interest rate Japanese industry could be happily profitable, while the “strong” American dollar caused by high American interest made it easy to penetrate our unprotected market.

A high interest rate (and our recent supposedly low rate was exceedingly high by Japanese standards, as well as by our own pre-1960 standards) is a market characteristic that makes for a high “natural” rate of unemployment. A low rate, contrariwise. The news was barely fit to print. Still, we’d be wise to pay attention to it.

The New Leader

[1] Ed.: I can’t help but wonder what the author would have thought of Clayton Christensen’s concerns with corporate focus on margins instead of profits as in the Innovator’s Dilemma, and his more recent thoughts on The Capitalist’s Dilemma.