By George P. Brockway, originally published February 24, 1997

THE LAST TIME I saw Michael J. Boskin on the tube, he was Chairman of the President’s Council of Economic Advisers under George Bush, and he was arguing against extending jobless insurance as the 1991 recession dragged on. Doing this would, he explained, discourage the unemployed from rushing to grab new jobs-jobs that were, he neglected to point out, a lot worse and paid a lot less than those they’d lost.

Now Boskin is being presented as the fellow with a nonpolitical scientific story about the Consumer Price Index. In 1995 the Senate Finance Committee put him in charge of an independent commission appointed to look at the accuracy of the CPI as a measure of inflation; a few months ago the panel issued its report, and since then he has been very much with us. As I listen to him these days, I am reminded of Carl Jonas‘ comic novel The Sputnik Rapist, in which an old goat of an aging mountain man is sweet talking an Indian maiden, whispering in her ear about the great time they’re having. She replies, “Well, perhaps, but I think I’m being screwed.”

I’ve already given you my notion that the CPI is not, and never was meant to be, a COLA. It measures changes in the price level, and that is not the same as changes in the cost of living (see “What Does It Cost You To Live?” NL, June 3-17, 1996). I don’t propose to go into that again in detail, but I do have a couple of points to add.

Professor Boskin and other members of his commission all have a lot to say about how the CPI doesn’t adequately measure the improvement in products over time. Automobiles last longer than in the past, they point out, so no wonder a car costs more. Well, I don’t know about you, but I run my automobile longer than

I used to because the new ones cost too much. In fact, the last new car I bought was in 1982.

Besides, they contend, items that used to be extras are now standard equipment, and so should be reflected in the CPI; what is more, the equipment is better than it used to be. Perhaps it is, but I used to be able (it was a fight, but I could win it) to buy a car without a radio and a tape deck and CD player and quadrilateral sound and white sidewall tires.

Still, the Boskin commission thinks the CPI should be cut 0.6 percentage points for these reasons.

Another claim they make, exactly contrary to the previous one, is that lots of things-literature, for example-are cheaper than they used to be. Eight or 10 years ago, a best-selling novel was $12.95 in hardcover; now it might be $25, but you can get a paperback for $10.95, and so are better off. (paperbacks once were 25 cents, but let that pass.) Indeed, they say, you don’t have to spend even $10.95, you can go to the library for free.

I seem to remember that we could go to the library for free when we were children and the world was young; so the cost of reading shouldn’t be a factor in the CPI anyhow, even assuming that the CPI measures changes in the cost of living rather than changes in the price level. Speaking of-libraries, however, how do you factor in the fact that increased book and magazine prices, coupled with decreased budgets, have forced reductions in the number of books purchased and also in the hours libraries are open?

Anyway, the commission wants to trim 0.4 percentage points for cheaper substitutes.

Finally, they want to knock off 0.1 of a percentage point for the availability of less expensive places to shop, like warehouses. I don’t know of such a place in my neighborhood; and even if there were one, I can’t imagine how I’d get the stuff home or where I’d store it if I did get it home. I’d have to rent a larger place, which would surely cancel the savings from buying wholesale, not to mention the interest I’d have to pay on my investment in canned goods.

The grand total of all the deductions comes to 1.1 percentage points. While this doesn’t sound like much, it amounts to between three-tenths and a half of recent COLAS. Everything I’ve said, of course, is anecdotal, but so are the explanations we’ve been given about the presumed inaccuracy of the CPI.

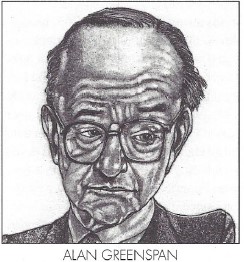

There is another issue that is not anecdotal at all; it goes to the heart of the conservative passion for cutting the CPI. That is the effect of the CPI on the interest rate. It should be of particular concern to Chairman Alan Greenspan of the Federal Reserve Board. Although he was the first to make a public clamor about the CPI, he seems to be bashful or (maybe) blind to this issue.

Almost always when he’s talking about the interest rate, Mr. Greenspan is careful to make clear whether he’s referring to the money rate or the real rate. When in 1993 he gave up on his attempt to use M2 to forecast the future, moreover, he indicated that the real rate continued to be the object of Reserve policy. The real rate, of course, is the money rate (the rate banks actually charge and we actually pay) less the CPI. Thus if the CPI is overstated by “at least” 1.1 per cent, the Federal Funds rate (the key rate the Reserve sets) is also overstated by at least 1.1 percentage points, as are all other rates.

This should give Mr. Greenspan and the Republican-New Democratic cabal furiously to think. Right now the outstanding debt of nonfinancial sectors of the economy is about $14 trillion. That $14 trillion includes everything from what you owe on your bank credit card through Treasury 30-year bonds. If the CPI is 1.1 per cent too high, the annual interest paid on that $14 trillion is 1.1 percentage points too high-or $154 billion, almost 50 per cent more than the current budget deficit.

Or look at it this way: During the past 10 years, while Alan Greenspan has been keeping the Federal Reserve’s eye trained on the “real” rate of interest, we-you, me, all the businesses of the land, and the city, state, and Federal governments-have paid over $1 trillion too much in interest. We will again pay $1 trillion too much in interest between 1997 and the mystic year of 2002.

Now, the most that any of the Boskin commission expects to gain by cutting the Social Security COLA, modifying the brackets of the income tax, and holding down government and service pensions and disability entitlements seems to be about $200 billion over the next six years. If the commission would just take Mr. Greenspan aside and explain to him how the CPI is overestimated, he could save five times what the commission wants to dock the elderly and disabled.

Not only that: Since he claims to have been aware for a long time of errors in the CPI, he could have made proportionate savings for us at any time in the last decade without bothering the elderly and disabled. The Federal Reserve Board is an independent agency with large staffs of well-paid economists, not only in Washington but also in the 12 district banks. It doesn’t have to base its policies on numbers crunched by the underfunded Bureau of Labor Statistics of the Department of Labor, which computes the CPI, or by the Boskin panel either.

If the Fed were to take a responsible approach to the CPI question, it would sooner or later (depending on how fast they can do simple arithmetic in their heads) come up with a solution that would render irrelevant the Boskin commission’s report and all the debate and talk shows and editorials it has inspired.

BEFORE GETTING DOWN to this solution, let’s make a minor adjustment in nomenclature. I used to talk about the “Bankers’ COLA,” but a friend has complained that the term made unfair fun of bankers; they, after all, are not the only ones to benefit from it. So suppose we now call it the “Fed’s COLA,” because it is the Federal Reserve Board that decides how big the interest rate’s cost-of-living adjustment is.

The simple arithmetic is this: The Federal Reserve Board decides on an estimate of the current rate of change in the CPI, and then adds that estimate-the Fed’s COLA-to the “real” interest rate (which is determined altogether separately) to set the “money” rate. Multiply the outstanding indebtedness of the nonfinancial sectors of the economy by the Fed’s COLA, and you get its cost to the economy.

Next, multiply the Gross Domestic Product by the same rate of change in the CPI (whatever it is). This will give you the cost of inflation to the economy, for that is what the Consumer Price Index is supposed to point to.

Lastly, compare these two costs. In today’s economy it will turn out, no matter what the rate of change in the CPI is, no matter how or by whom calculated or by whom approved, that the Fed’s COLA costs the economy almost twice what inflation costs. The plain and simple reason, as Tom Swift used to say in a marvelous old series of books for 10-yearolds, is that the outstanding indebtedness of the nonfinancial sectors of the economy is, and has been for many years, almost twice the Gross Domestic Product. So when you multiply them both by the same number, no matter what it is, you get figures that are different by nearly a factor of two.

It doesn’t take Tom Swift to see that if there were no change in the CPI, there would be no Fed’s COLA. Conventional economics, which is perhaps not so smart as Tom Swift, concludes that the thing to do is to get inflation down to zero, whereupon the interest rate could be lowered because the Fed’s COLA would be reduced to zero, too. In order to get inflation down to zero, though, the Federal Reserve Board (which is nothing if not conventional) raises interest rates to control inflation putting us right back where we started from.

Since interest rates are set before things are made, and hence before prices are set, one might rationally expect that the proper procedure would be to get rid of the Fed’s COLA, which (if the estimate of the CPI change is correct) would get rid of inflation as a consequence. And if we got rid of inflation, we could get rid of all the other COLAS. And nobody would be hurt, as people are being hurt today. For a variety of reasons, this could not happen overnight. I’ll name two: First, monetary policy seems to take about two years to have a substantial effect. Second, most existing indebtedness has many years to run. But it shouldn’t take Tom Swift to convince us that we ought not to do the wrong thing just because doing the right thing takes time.

The New Leader