By George P. Brockway, originally published October 5, 1987

ANOTHER BUDGET deadline has come and gone and that old devil deficit is still there. What can we do about it? First, we had better consider briefly what would happen if Gramm-Rudman- Hollings were successful in getting the annual deficit down to zero. For we’d have a crashing depression, that’s what would happen. Whether the miracle were achieved by reducing military expenditures or by cutting off the poor or by raising taxes or by all three, somehow $160 billion (more or less) would be abstracted from the economy.

Actually, “abstracted” is the wrong word. The $160 billion would not be taken from the spendthrift government and put in your thrifty pocket to be used in a more propitious time. No, all that lovely money would not exist. Moreover, the possibility of its existence would be gone forever, and with it the goods and services the money might have bought, plus the goods and services that might have been bought by those who would have earned money by producing the first lot, and so on ad infinitum. R.F. Kahn‘s multiplier works both ways.

Or look at it this way: One hundred and sixty billion dollars is about 4 per cent of our gross national product. The average fall in GNP for depressions since World War I has been about 6 per cent. The possibility is more ominous when you consider the unemployment rate. In 1929, the rate was 3.2 per cent. Today, it is officially stated to be 5.9 per cent-and this counts part timers as fully employed, and doesn’t count at all those who are too discouraged to look for work. In other words, we have a head start on any depression we decide to bring about.

Mention of unemployment reminds us of the real point: The vice of depression is not the loss of potential goods and services but the loss of jobs and self-respect. No one can spend much time in the labyrinths of a shopping mall without concluding that we already have more goods and (perhaps) services than we-literally-know what to do with. Our basest beggars are in the poorest thing superfluous. Personal dignity and self-respect depend on the right to contribute to the common wealth. Even without a depression too many of us are denied that right. We are all demeaned by that denial.

Does this mean we are doomed to run deficits forever? Won’t all that debt bring double-digit inflation back again? And isn’t it irresponsible to pass on to our children the consequences of our fecklessness?

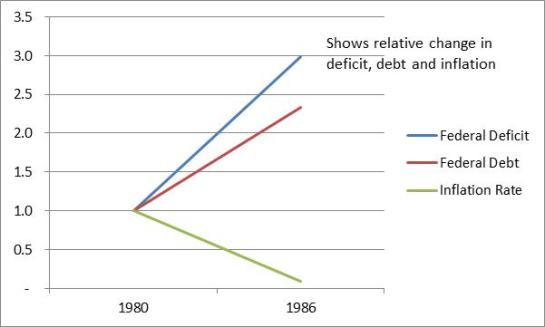

When you look at the record, you wonder how these staples of campaign oratory and editorial punditry get taken seriously. In 1980, the deficit was $73.8 billion (or 2.7 percent of GNP), and the gross Federal debt was $914.3 billion (or 33.47 per cent of GNP); the inflation rate was 12.4 per cent. Last year the deficit was $220.7 billion (or 5.2 per cent of GNP), and the gross Federal debt was $2,132.9 billion (or 50.68 per cent of GNP); the inflation rate was 1.1 per cent. There is no way these figures can be tortured to support the claim that a deficit causes inflation (see editor’s chart below).

Well, the states balance their budgets, so why can’t the Federal government? Of course, it could-provided we accepted one of two outcomes: Either private businesses and private individuals would have to increase their indebtedness to match the Federal decline, or we would have to have that depression. The reason for this is simple: The flip side of debt is credit, and credit is money. (If you want to be fussy: not all credit is money, but all money is credit.) Without debt, no credit; without credit, no money; without money, no business. That’s the way the capitalist system works. That’s the golden-egg-laying goose that myopic conservatives want to kill.

But what about our children and theirs? As Keynes observed, it is no favor to our children to neglect our natural and civic and domestic environments and thus save our children from the perils of indebtedness in their adulthood at the expense of forcing them to spend their childhood in squalor.

The foregoing merely suggests ways in which the anti-indebtedness argument is false. It does not claim that the present is the best of all possible worlds, that the level of our current deficit is exactly right, that we might not better buy different things with our money, or that we might not do better by financing the deficit differently.

Let it be said at once that the appropriate level of the deficit is a matter of trial and error. In spite of the most sophisticated programs run on the most powerful computers, Pandora’s box remains closed to us. Consequently, to say that we can fine tune the economy is an exaggeration. It is, however, a fact that we have, in the record of the past 40 years, proof that some kind of tuning can have significant results.

This brings us to the probability that at some time-perhaps tomorrow, perhaps the day after-we may want to tinker with the new tax law we hailed so proudly only yesterday. We may, in any case, want to remind ourselves that taxation is not necessarily for revenue only. Attending a debate in the Academy of Laputa[1], Lemuel Gulliver was struck by a proposal “to tax those qualities of body and mind for which men chiefly value themselves …. The highest tax was upon men who are the greatest favorites of the other sex; and the assessments according to the number and nature of the favors they have received, for which they are allowed to be their own vouchers …. But, as to honor, justice, wisdom and learning, they should not be taxed at all; because they are qualifications of so singular a kind that no man will allow them in his neighbor, or value them in himself.”

That excellently bitter proposal is not explored in the 291-page Description of Possible Options to Increase Revenuesrecently prepared by the staff of the Joint Committee on Taxation with the staff of the Committee on Ways and Means. Part I examines what it discreetly calls” Revenue Areas [it would be lese majeste to call them tax increases] Addressed by the President’s 1988 Budget Proposals.” Adopting all of them would increase 1988 revenues by about $3.7 billion-scarcely noticeable in the shadow of a $160 billion deficit. Part II, taking up the document’s remaining 257 pages, examines “Other Possible Revenue Options,” most, if not all, having been suggested by members of the Committee on Ways and Means. These naturally reflect the various members’ interests and capabilities, and many are nutty (as are some of the President’s), while others are politically impossible, at least for now. Though it is likely that, as a whole, they exceed the magic $160 billion goal, there is no point in adding them up because many of them would work at cross purposes, and because nowhere in the pamphlet is there a discussion of the leading weakness of the 1986 tax law.

This weakness is the almost complete abandonment of progressivity. The great strength in the new law is that the grossest shelters were blown down. But, as is well told in Showdown at Gucci Gulch by Jeffrey H. Birnbaum and Alan S. Murray, the Senate Finance Committee grudgingly accepted the strength in order to achieve the weakness.

The attack on progressivity has been going on for several years. It was not so long ago that the top bracket in the personal income tax was 85 per cent. Then it was reduced to 50 per cent on “earned income.” Then to 50 per cent on all income, except for capital gains, which were taxed up to 35 per cent. Then capital gains were dropped back to 20 per cent. And now the top rate is 28 per cent across the board, with a complicated proviso that need not be of concern to you unless your taxable income exceeds $200,000. (The proviso, allowing for certain deductions at the lowest rather than at the highest rate, was one of the few good ideas of the original Bradley-Gephardt proposal. See “A Cautionary Tale of Tax Reform,” NL, January 27,1984.)

HOPE OF CHANGING the tax law’s rate of progressivity was abandoned by everyone who entered the Congressional conference rooms. It was insisted from the start-by Bradley-Gephardt in 1983 as well as by Reagan- Regan in 1986- that a reformed tax law would be revenue neutral. This shibboleth meant not merely that the total revenue raised under the new law would be the same as that under the old, but also that the various quintiles of income recipients would pay the same proportions of the total tax under both laws. An exception was that certain of the poorest of the poor, who had been added to the rolls in the reactionary surge of 1981-82, would now be dropped again.

The new law is certainly better than the old in that whatever is unreasonable or unjust in it is plainly stated rather than shoddily sheltered. But that is not to say it is more reasonable or just. It may, in fact, lead to greater injustice. It is probable that throughout the corporate world executives will demonstrate an increased eagerness for high salaries because they will be able to keep a higher proportion of them. It is probable, too, that the kind of investment banking that leads to raids and takeovers and greenmail will be stimulated, and that so will the securities and commodities and futures markets. It is even probable that the changes in the corporation tax will encourage many companies to increase executive perks, on the ground that the tax collector would get the money if it weren’t spent on limousines and Lear jets.

It will be noticed that the foregoing probabilities are to some degree contradictory. It is something of a paradox that lower personal and higher corporate taxes can be expected to result in both higher executive salaries and perks as well as higher winnings from speculating in the securities of the companies whose earnings are reduced by paying the salaries and perks.

This can happen all at once through an accentuation of the polarization of the American economy. The rich can become richer by keeping the poor in their place and by pushing more of the middle class down to join them. The trend can continue for a damnably long time without arousing much political reaction. The possibility of an economic reaction is more immediate. As Jean Baptiste Say, in one of his acuter moments, wrote, “There is nothing to be got by dealing with people who have nothing to pay.”

Our economy is bad because our morale is bad. For too many years, greed has been admired in high places and doing good has been sneered at. A steeply progressive income tax would be a sign of a shift in morale-which would be far more important than whatever increased revenue might be raised, and vastly more important than the size of the deficit.

The New Leader

[1] Readers with a bent for trivia may recall that one of the targets of Major Kong’s B-52 in the movie “Dr. Strangelove” was Laputa. According to IMDb, “Major Kong’s plane’s primary target, is an ICBM complex at Laputa. In Jonathan Swift‘s 1726 novel ‘Gulliver’s Travels’, Laputa is a place inhabited by caricatures of scientific researchers.”